Paying the Cost

AGFC discusses the price of maintaining Arkansas’s wild spaces

By Dwain Hebda

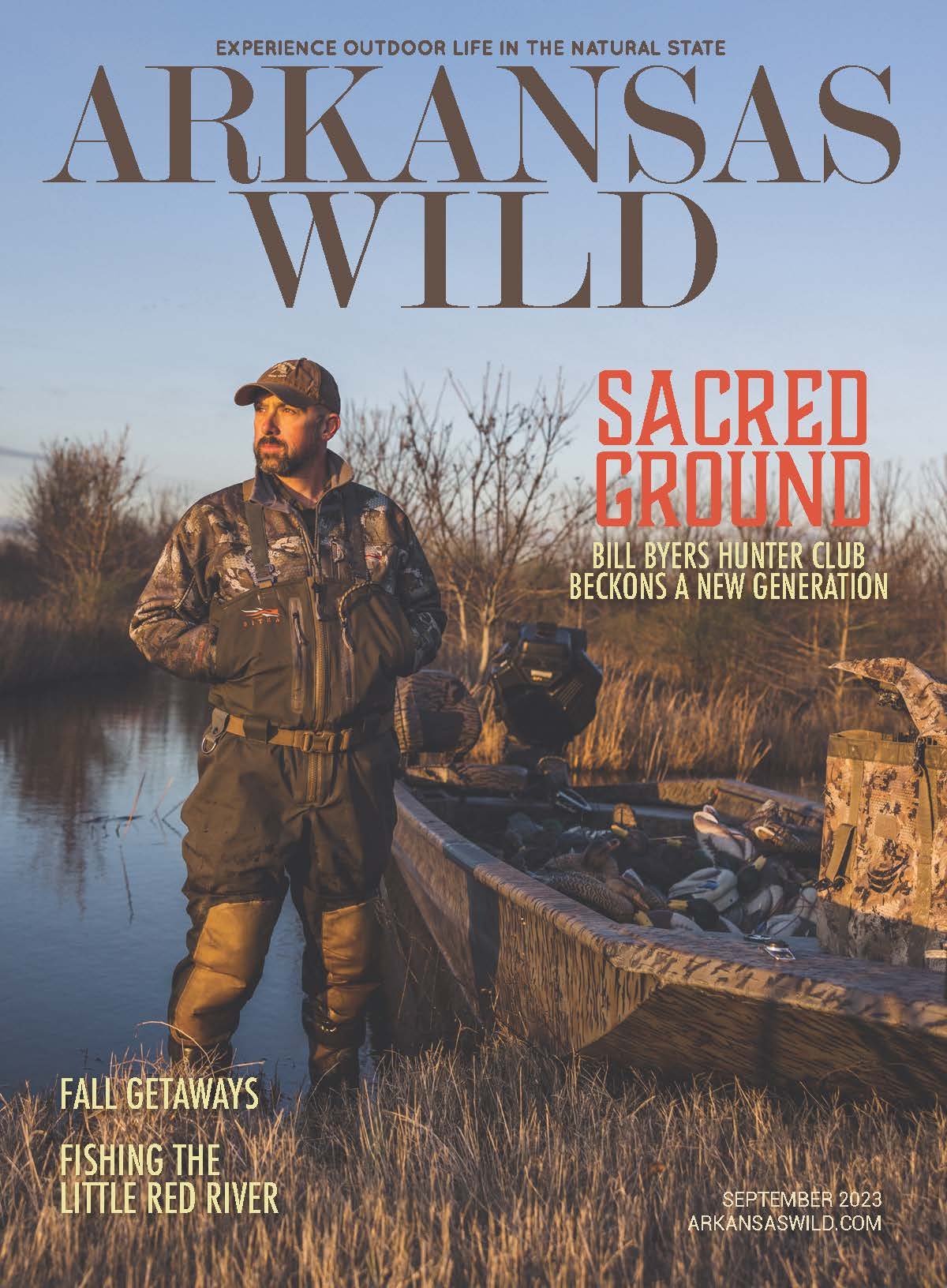

Preserving tranquil scenes like this one on the Little Red River takes funding and manpower. -Photo courtesy of Greg Seaton, Little Red Fly Fishing Tours

It’s an ordinary workday at the low, broad-shouldered headquarters of the Arkansas Game and Fish Commission, tucked into wooded acres just off West Markham Street in Little Rock. Inside, it looks like any other office building, save for the massive fish mounts just down the stairs from the entrance and the captivating wildlife photography lining the halls.

The offices are comfortable, but not particularly plush. Deputy Director Chris Racey’s office looks more like a break room than the enclave of the co-second-ranking executive in the organization. Racey, who immigrated to Arkansas from Pennsylvania for college, doesn’t give it a second thought. Around here, less spent on stuff indoors means more to spend on the stuff out there.

“Let me get this in there because I think it’s critical: We could not do this without the people of Arkansas contributing to conservation, whether they’re buying fishing and hunting licenses or via the conservation sales tax,” Racey said. “It’s really important that your readers understand that they’re contributing day in and day out and they have influence over what conservation looks like in our state just based on those funding models.

“It’s amazing what has been accomplished so far because of what they’ve done. There’s a laundry list of things Arkansans get for what we’re doing operationally. We do everything we can to provide that broad opportunity.”

Per a 2017-2018 report, AGFC manages 600,000 acres of lakes and 100,000 miles of rivers. Racey added the commission also manages 3 million acres of land, of which 385,000 acres are owned. The commission covers operations and upkeep for 140 Wildlife Management Areas, six hatcheries and net pens, 10 regional offices and eight education and nature centers with another coming online soon. It’s hard to utilize something in the Arkansas outdoors that doesn’t bear the AGFC stamp.

“We’ve got over 400 boating access areas across the state,” Racey said. “People are able to take advantage of that if they’re fishing, they’re tubing, they’re swimming or maybe they’re part of this kayak revolution that folks are on. They don’t always understand it’s a boat ramp maintained by the Arkansas Game and Fish Commission, but they sure know it’s there and they love to use it and we’re proud that they can.”

The commission manages all of these assets on a budget of just under $92 million for FY2020. By comparison, Oklahoma spends $40 million on its game and fish; Tennessee, $86 million; Louisiana, $123.4 million; Missouri, $161 million; and Texas around $287 million.

Larger budgets don’t tell the whole story, however. A 2014 study by the Southern Legislative Conference compared 11 states’ gaming, fishing and wildlife spending and found Arkansas returned comparatively more money to the citizenry. The Natural State spent $26 per capita, roughly on par with Alabama ($26.18), Mississippi ($24.19) and Missouri ($29.94); and far ahead of Texas ($13.76), Kentucky ($11.74), North Carolina ($7.56), Virginia ($7.38), Georgia ($5.46) and Ohio ($5.14).

The AGFC is funded via three streams. The 1/8 of 1 percent Conservation Sales Tax, passed in 1996, provides more than 40 percent of the annual budget, just under $33 million. Next come license sales, generating about $26 million and federal funds totaling just over $22 million. About $10 million comes from miscellaneous receipts. The Arkansas Game and Fish Foundation raises additional monies to augment the AGFC budget, directed to specific programs or initiatives.

Sales tax and the license sales funding represent a good news-bad news scenario.

“Since it was adopted, the Conservation Sales Tax has generated somewhere in the neighborhood north of half a billion dollars for conservation on the ground of our state,” Racey said. “That’s significant, and that’s all Arkansans contributing to that, which is exciting. We’re talking about something that many other states are envious of and don’t have.”

On the other hand, license sales have dropped steadily since the tax was enacted. Resident fishing licenses have decreased 18 percent from 381,000 to 312,000 between FY14 and FY19 and trout licenses down nine percent from 105,000 to 95,000. Hunting licenses have tumbled 15 percent from 258,000 to 220,000 and duck stamps are down seven percent, 57,000 to 53,000, in five years.

This is not only a direct financial hit, but as some federal funds are apportioned according to licenses sold, fewer permits means decreased dollars from Uncle Sam. Racey said this disturbing trendline must be reversed in order to maintain current services, most of which – from access to AGFC ground to admission to Nature Centers to fishing derbies – are provided free of charge.

“For folks who love the outdoors, who love the idea of Arkansas being The Natural State, even if they’re not consuming every part of what The Natural State has to offer, the number one thing I would tell them to do is go buy a hunting and fishing license,” Racey said. “You don’t have to hunt or fish a day in your life. It doesn’t matter. You will have contributed to conservation in an additional way past the conservation sales tax.”

“That enables us to put conservation on the ground, enables you to enjoy things outside. Whatever it is you like, all of that opportunity is out there.”